Alkaline Fuel Cell Power Corp. (OTCMKTS:ALKFF) Talks of Milestones in 1st Half of 2022 and Outlines Plans for 2nd Half of the Year

Alkaline Fuel Cell Power Corp. (OTCMKTS:ALKFF) is a diversified investment company that focuses on developing renewable, reliable, and affordable energy assets and cleantech. The company tagline is “Power to the People”, which is something the management firmly believes in. They intend to combine a steady revenue stream with a future-forward vision to commercialize their advanced hydrogen fuel cell technology. It is expected to match up to the enormous global market requirements, and ultimately generate substantial returns for investors.

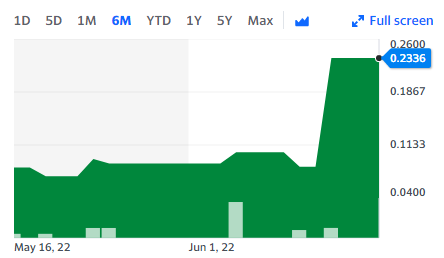

Market Stats

On Friday, ALKFF stock ended flat at $0.2336 with 1K shares, compared to its average volume of 355 shares. The stock moved within a range of $0.2336 – 0.2336 after opening trading at $0.1226.

Alkaline Fuel Cell Power Highlights First Half 2022 Milestones and Provides Second Half 2022 Outlook

Alkaline Fuel Cell Power Corp. on June 20, 2022, has provided updates regarding achievements in the first half of 2022, and also shared plans regarding the second half of the year, and beyond.

Achievements of 1st half of 2022

The first half involved the appointment of Frank Carnevale, as CEO, and Carmine Marcello as Advisor, effective May 10th and June 16th respectively, along with the listing of company shares on the OTCQB on March 28th under the ticker “ALKFF”. It has acquired AI Renewable’s CHP (combined heat and power) business, which involves a pipeline of potential projects including an estimated $50 million of additional CHP systems that can be brought into commercial operation over the next 24-36 months.

The company also rebranded this business to PWWR Flow Streams. The first key milestone was achieved in the development of our hydrogen fuel cell, with the successful creation of a functioning, bench test, single stack, and system operation at working temperature.

Plans for 2nd half of 2022 and beyond

The company plans to improve financial flexibility by tapping into opportunities for leveraging the use of flow-through shares to minimize AFCP’s equity requirements for the ongoing development and advancement of CHP projects. By leveraging the ongoing revenue and earnings generated through PWWR Flow, it plans to grow the company’s asset installation base. It also intends to raise working capital for acquisitions and growth capital.

Apart from that, it plans to identify, nurture and execute strategic acquisitions of additional attractive energy assets, earnings-positive service companies in the power and energy space, and/or synergistic clean technology assets or companies. Last but not the least; it plans to expand on the commercialization of fuel cell power NV.

Key Quote

“In addition to ongoing success in the development of our alkaline fuel cell technology, AFCP is prudently diversifying into assets offering more immediate revenue potential to support its eventual transition to sales of alkaline fuel cells,” commented Frank Carnevale, Chief Executive Officer. “I’m pleased to announce that AFCP is advancing its acquisitions, investments, and scaling of our energy asset business activities over the second half of 2022.”