Intel Corporation (NASDAQ:INTC) Expects To Unveil 11Th Generation Tiger Lake Processor At September 2nd Event

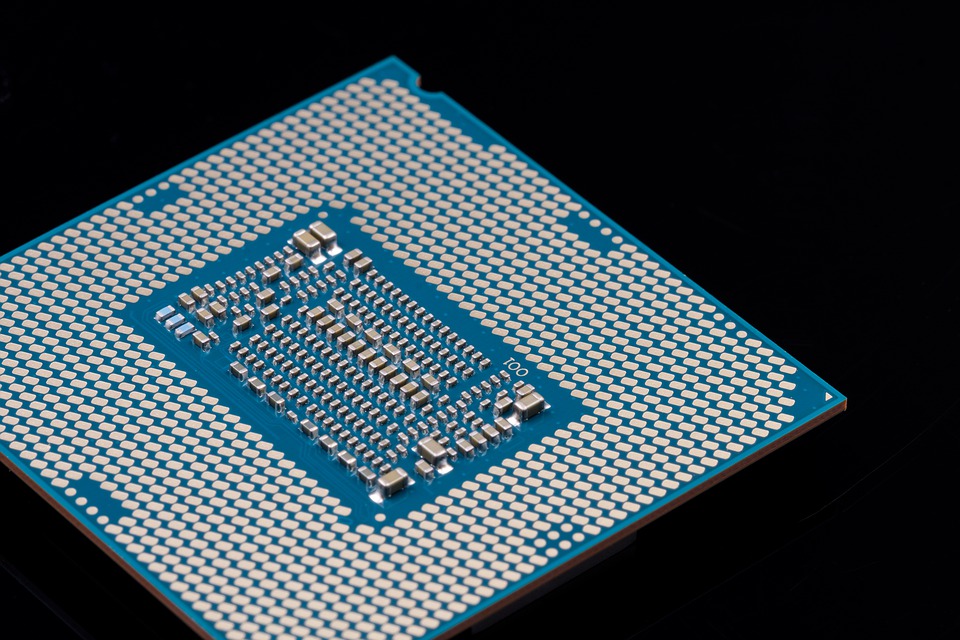

Intel Corporation (NASDAQ:INTC) will introduce 11th generation, 10 nm Tiger Lake Processor at an event on September 2, 2020, for use in laptops. The new processor supports Xe graphics architecture.

Competes with Ryzen 4,000 Chips

The new 10 nm processors, which are the next iteration of the previous 10nm+ architecture, will compete with Advanced Micro Devices, Inc. (NASDAQ:AMD)’s Ryzen 4,000 series Chips. Advanced Micro addresses light and thin gaming laptops and normal business laptops with multiple chip offerings to clinch a large market share.

Early release of Tiger Lake CPU

Tiger Lake Processors are making an entry in H2 2020, though Intel previously planned to release them in 2021. Intel already shipped development kits in mid-February this year to its partners for testing and validation.

Manufacturers like Acer will introduce laptops with 11th Generation Intel processors this fall in the market. Tiger Lake processor replaces the architecture of ice lake processors, which feature 10nm architecture.

Improvement in graphics performance

The new Tiger Lake processor brings improvements in graphics performance and processing speed. It also boasts improved artificial intelligence (AI) and the latest version of wireless connectivity. Tiger Lake Processors are restricted to U series and Y series mobile CPUs.

The new processors will offer better performance compared to the ice lake series. It expects to boast a clock speed of 3GHz and, at peak, reaches 4.3 GHz. In terms of graphics, it will offer 15% better performance compared to Advanced Micro’s Ryzen 4800 series.

Tiger Lake CPUs are offered in three flavors – H, U, and Y. Several laptop vendors and OEMs tested new Lake U and Y models and will include these in their new laptops. The flavor Y boasts 8 threads and 4 cores 4.5 to 9W TDP CPU.

Intel shares trade flat at $61.13 on July 22, 2020, afternoon ahead of the release of Q2 2020 earnings, which are expected to be slightly above the estimates. The sales of PCs expect to increase by 2% to 11% in Q2.

Texas Instruments Incorporated (NASDAQ:TXN) reported a drop of 12% YoY to $3.24 billion in Q2 2020 because of weak demand in the automotive. It could post better earnings going forward, considering its ability to quickly develop and market innovative products to meet the technology sector’s demand.