Lincoln Park Bancorp (OTCMKTS:LPBC) Stock In Focus After Recent Development

Lincoln 1st Bank is the wholly-owned subsidiary of Lincoln Park Bancorp (OTCMKTS:LPBC). Established in 1923, Lincoln 1st Bank gives a diverse range of online as well as brick-and-mortar financial services. The bank provides loans, mortgages, loans as well as deposit products for supporting a community of commercial and retail customers. Headquartered in Pine Brook, New Jersey, Lincoln 1st Bank operates two branch locations in Lincoln Park and Montville, New Jersey.

Market Stats

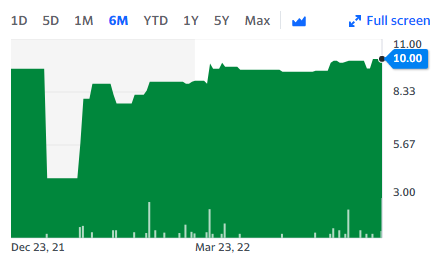

On Wednesday, LPBC stock ended flat at $10 with 780 shares, compared to its average volume of 334 shares. The stock moved within a range of $10.00 – 10.00 after opening trading at $10.

Ion Financial, MHC, and Lincoln Park Bancorp Announce Receipt of Requisite Regulatory and Stockholder Approvals to Complete Merger

New Jersey-based Lincoln Park Bancorp, the holding company of Lincoln 1st Bank, and Connecticut-based Ion Financial, MHC on June 22, 2022, announced receiving all the necessary regulatory approvals for completing the merger. Lincoln Park Bancorp’s stockholders gave consent to the merger at a Special Meeting of Stockholders last week. Both parties are expecting to complete the merger by July 1, 2022.

Hogan Lovells US LLP is the legal counsel to Ion Financial, MHC, and Ion Bank whileLuse Gorman, PC is the counsel to Lincoln Park Bancorp, MHC.

Earlier in April 2022, Lincoln Park Bancorp had announced a net loss of $1.2 million or $0.71 per diluted share for the year months ending December 31, 2021. This was much lower than $2.2 million or $1.28 per diluted share for the three months ending December 31, 2020. The firm confirmed a net loss of $339 thousand for December 2021 vis-à-vis $1.7 million for the quarter ending December 31, 2020. The company confirmed that the Net interest income for the year ending December 31, 2021, reduced to $862 thousand, or 17.0%, to $4.4 million as compared to $5.3 million vis-à-vis the previous year. The provision for loan losses was reduced by $1.3 million by December 31, 2021, because of the assessment of its environmental factors. The Non-interest income surged from $ 370 thousand, or 32.3%, to $1.5 million for the year ended December 31, 2021. This was because of the realized gain from selling the former Lincoln Park location.

In 2021, Ion Bank and Lincoln Park Bancorp, MHC announced entry into a definitive agreement. This would result in a merger and dissolving of Lincoln Park Bancorp, MHC. Unanimously approved by the boards of directors, the merger was amended in March 2022 for fixing cash merger consideration at $10.10 per share.

Traders Corner

LPBC stock is trading above the 20-Day and 50-Day Moving averages of $9.54 and $8.91 respectively. Moreover, the stock is trading above the 200-Day moving average of $8.20.